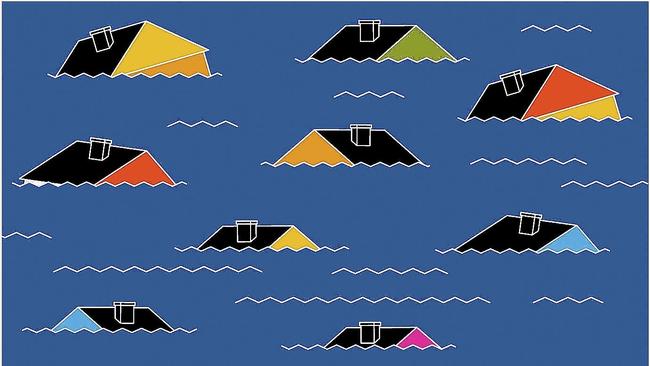

The recent news on natural disasters has caused many people to think about disaster preparedness.

The impact of weather and other natural disasters will cause life-changing damage to your property. You will want to immediately replace the important lost items to bring normalcy back to your life.

To get through the insurance claim process after a natural disaster, preparation is key. The National Association of Insurance Commissioners has a consumer-friendly link to help. I will be referring to some of the information in this website, along with other resources in addressing common questions relevant to natural disasters.

What is flood insurance?

You can purchase flood insurance from an insurance carrier authorized by the National Flood Insurance Program (NFIP) to sell flood insurance coverage. The Federal Emergency Management Agency (FEMA) administers the NFIP and has a reference number to help you identify an insurance agent authorized to sell flood insurance in your area (1-800-427-4661). You can access more FAQ about flood insurance here.

How do I know whether I need flood insurance?

The need for flood insurance can be triggered by forest fires, weather, and changes to geography in your area caused by new construction, erosion, rivers and streams, and other factors. Your local flood control district may have the most current information identifying flood zones in your community.

Water does not care if you rent or own your property, so it is always good to know whether your home is likely to be impacted by flood waters. Even if you believe your home is outside of a flood zone, flood insurance is a safe move.

Flood insurance becomes a necessity if your mortgage lender requires the insurance to finance your home. Regardless of your mortgage lender’s requirements, your own peace of mind may influence your decision on flood insurance.

Does flood insurance cover the structure and all the items inside?

Flood insurance will not cover your furniture or personal items in your flooded residence unless you purchase flood insurance coverage for the contents of your home or rented property.

Before disaster strikes, you should work with your insurance agent or company to ensure that your homeowners or rental policy cover the contents of your home. You can use this NAIC checklist to create your own inventory and update your insurance company on new personal items that you want covered.

If there is a natural disaster, do I need a public adjuster to help me with my claim?

Depending on a variety of factors, a public adjuster may be of assistance. Please see my prior comments regarding hiring a public adjuster here.

Will flood insurance provide enough money to replace my home?

This question is best answered by reviewing the information on your flood insurance policy and reviewing the policy provisions on a regular basis. There are generally two kinds of coverage for your homeowners’ insurance: “all risk,” or “named peril” policies.

If you intend to have replacement coverage for your home because of potential flood events, I encourage you to contact your insurance company to confirm what kind of homeowners’ insurance policy you have in place.

You may also want to confirm whether your flood insurance policy is for “replacement cost” or “actual cash value.” This is an important difference to determine whether the funds received for your claim will be enough to replace your home and property.

I encourage you to discuss the difference with your insurance company when analyzing your policy. If the value of your residence has substantially increased, you may find you are underinsured and lack sufficient funds to rebuild or replace the damaged property.

A word about mobile homes; they have insurance policies similar to auto insurance policies. See information about auto policies below.

Does flood insurance help with my auto policy?

Auto policies with casualty coverage should cover the replacement of your car, truck, SUV, or mobile home in a disaster event. This coverage is different from the minimum insurance coverage most states require for you to show financial responsibility when you register your vehicle.

You can also purchase medical coverage for yourself as part of your auto insurance policy. This is helpful in case you are injured during the natural disaster while in your vehicle. Review your policy with your insurance company to confirm whether you should add these provisions to your policy.

If I have flood insurance, what do I need to show evidence of my losses?

This is a tricky question because the time to prepare for evidence of any losses is before the natural disaster event. You need to show what you owned and what was damaged/lost. You can use the resources identified in the NAIC website described above to help you develop the list of household items. The insurance adjuster from your insurance company or your public adjuster will help you document your claim.

Yvonne R. Hunter is a licensed attorney and the Principal Consultant for YH Strategies, LLC, in Phoenix, Ariz. After a stint with the Arizona Department of Insurance, she learned that many consumers remain unaware of some of the issues associated with insurance products. This blog reflects her opinion and should not be regarded as legal advice. She encourages consumers interested in learning more about their own insurance experience to contact their state department of insurance or insurance commissioner or seek advice from an attorney. If you would like additional information on matters dealing with consumer insurance products, you can reach Yvonne at yrhunteraz@gmail.com.

Yvonne R. Hunter is a licensed attorney and the Principal Consultant for YH Strategies, LLC, in Phoenix, Ariz. After a stint with the Arizona Department of Insurance, she learned that many consumers remain unaware of some of the issues associated with insurance products. This blog reflects her opinion and should not be regarded as legal advice. She encourages consumers interested in learning more about their own insurance experience to contact their state department of insurance or insurance commissioner or seek advice from an attorney. If you would like additional information on matters dealing with consumer insurance products, you can reach Yvonne at yrhunteraz@gmail.com.